Spreadsheet Time Sheets can be a simple but effective way to gather employee time. A time keeper can enter a whole crew’s time into a single sheet and submit the data. Anyone with basic computer skills can act as a time keeper, and it is very easy to review and edit the data for accuracy before it is processed.

Clients who utilize time clock systems can generally submit their data in spreadsheet format, making it easy to import. Using INTERAC InterLink import/export utilities, data from a spreadsheet is easily imported directly into payroll for processing, eliminating the errors and time spent with manually keying the data in.

For clients who need a more complete payroll solution, INTERAC offers the Payroll Data Entry application, which is an easy way to offer just the functionality that is needed. It can be run as a stand-alone application at the client site, as a hosted application on a cloud server, or an in-house terminal server, whatever fits the requirements best.

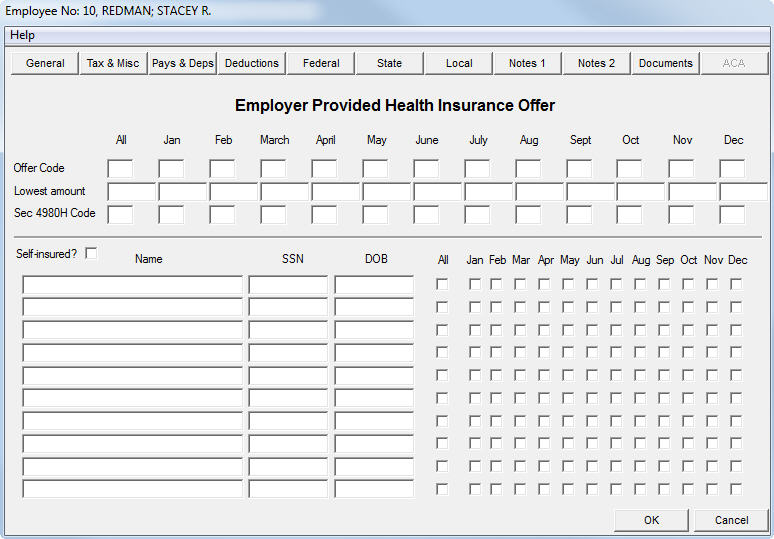

Payroll Data Entry is ideal for client installations, particularly where they need the ability to process payroll and print checks in-house. Because it is a subset of the actual payroll application, it offers lots of capabilities:

- It provides complete payroll data entry capabilities because it includes the actual payroll journalizing application. If that is all that the client needs, the transaction files may be submitted for processing.

- Clients can manage their own employee setup, adding and editing employees as needed.

- Where appropriate, clients are able to complete the payroll process, printing checks, and disbursing direct deposits.

- The system generates the payroll data files for distribution to the General Ledger, but it does not have the ability to post. This prevents posting before they have been reviewed.

Other Resources:

Payroll Data Entry Brochure

RSS Feed

RSS Feed